We help executives navigate equity markets.

| Our Approach

Research-driven recommendations

Our talented team focuses on providing research-driven recommendations through our Continuous Market Sentiment Research (CMSR) process, which we developed to provide executives with regular, candid insight into their investor base and peer communications.

We apply our insights across a full suite of investor relations services, helping to craft a narrative that resonates with the investment community and ensuring that management is always prepared to address investor concerns.

At Veridian, our clients' credibility is paramount, and our advisors closely partner with the existing Investor Relations team to ensure world-class investor relations preparation and materials.

| CMSR

What is Continuous Market Sentiment Research (CMSR)?

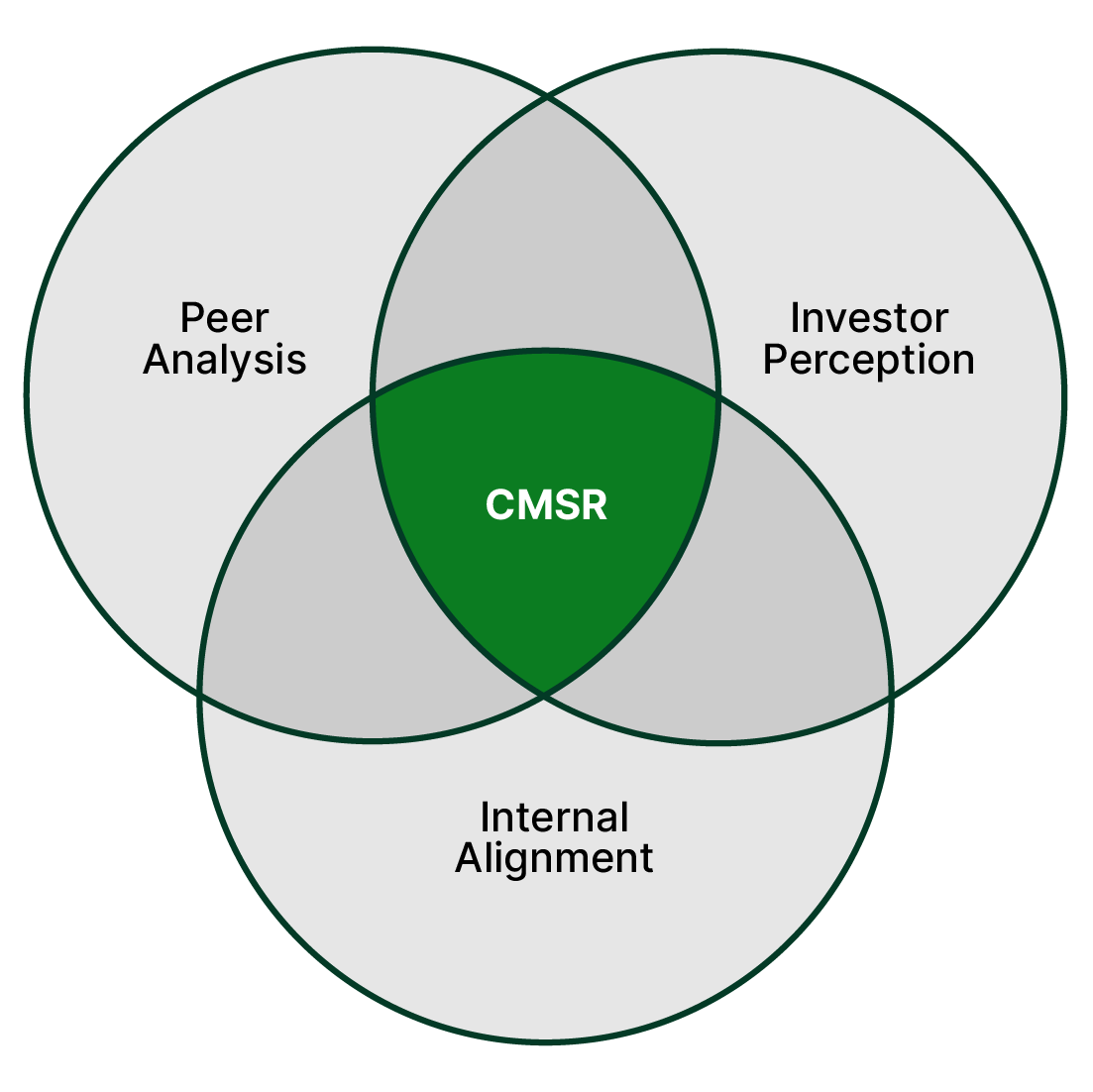

Our CMSR approach provides insights to confidently inform your team’s strategic decision-making, improve key messages, and ensure your executives are prepared for any scenario. By combining rigorous peer analysis, in-depth investor discussions, and regular alignment with your team, we’ll ensure you always have a comprehensive, up-to-date understanding of investor sentiment and peer communications.

The CMSR approach underpins every aspect of our practice, so you can be assured that every deliverable, including scripts, press releases, presentations, and executive Q&A preparation, is informed by the most up-to-date investor and peer data.

| Public Company Services

More confident messaging

Our services are underpinned by our CMSR approach, so you can rest easy knowing that your company’s investor materials were constructed by considering the most up-to-date investor and peer data.

This ensures a clear, concise, and consistent message that enhances executive credibility with your investor base, meaning less surprises and more confidence in your message.

Services:

-

CMSR reports are regular updates based on our ongoing peer analysis and investor discussions. These reports ensure your team always knows what is going on in the market. CMSR reports include:

• Ongoing Investor discussion reports

• Comprehensive Peer Analysis Reports

• Regular alignment meetings with the Veridian team

• Availability to deliver CMSR insights when you need them -

Our CMSR approach informs all of our ongoing services to create a clear, concise, and consistent message, taking into account the most up-to-date investor sentiment and peer communications. Ongoing Services include:

• Shareholder analysis

• Consensus analysis

• Guidance analysis

• Investment narrative development

• Executive Q&A preparation

• Peer stock performance analysis

• Materials preparation

• Investor targeting

• Corporate access planning

• All IR-related administrative and logistical tasks -

Episodic services do not take place in isolation of your broader Investor Relations strategy, so we don’t treat them that way. We leverage our CMSR approach to gain a comprehensive understanding on how to best position each episodic event within you company’s broader story. Episodic services include, but are not limited to:

• Spin-off messaging and preparation

• Transaction advisory and communication strategy

• Investor day planning, development, and preparation

• Administrative services and logistics

| Private Company Services

We set you up for success

Using our CMSR approach, we help you create a credible, compelling investment narrative that provides a foundation for your broader investor communications strategy.

We work closely with your team to ensure we utilize all available data to set you up for success, whether you are raising private capital or targeting an Initial Public Offering.

Services:

-

CMSR reports are regular updates based on our ongoing peer analysis and investor discussions. These reports ensure your team always knows what is going on in the market. CMSR reports include:

• Ongoing Investor discussion reports

• Comprehensive Peer Analysis Reports

• Regular alignment meetings with the Veridian team

• Availability to deliver CMSR insights when you need them -

Our CMSR approach informs all of our ongoing services to create a clear, concise, and consistent message, taking into account the most up-to-date investor sentiment and peer communications. Ongoing Services include:

• Investment narrative development

• Forecasting and guidance development

• Peer performance valuation analysis

• Board and investor materials preparation

• Investor targeting

• Corporate access planning

• All IR-related administrative and logistical tasks -

Episodic services do not take place in isolation of your broader Investor Relations strategy, so we don’t treat them that way. We leverage our CMSR approach to gain a comprehensive understanding on how to best position each episodic event within you company’s broader story. Episodic services include, but are not limited to:

• Fundraising advisory

• Private transaction advisory

• IPO advisory